The Financial System Is Contrived To Its Core. The Truth Is Out, And You Need To Know

Many individuals struggle to keep pace with the increasing cost of living, primarily influenced by a financial system not operating fairly. Or, to put it bluntly, the economic system is rigged. Corporations, governments, and those in positions of authority face immense amounts of debt in the trillions that cannot realistically be repaid. Their choices are either to default and face severe consequences or to reduce the value of this debt through inflation and manage it through regulations. Unfortunately, they have opted for the latter, to the detriment of the collective society.

This article exposes the financial system's flaws, highlighting three key factors contributing to its dysfunctional state. First, a disconnect between money and currency leads to a distorted view of their true value. Second, the time value of money is manipulated, creating an unfair advantage for specific individuals and institutions. Lastly, the ease of access to credit in a credit-driven economy has created an unsustainable cycle of borrowing and debt. These factors combined have rigged the financial system, creating an unequal playing field for all participants.

The article also sheds light on the reasons behind your struggle to keep up with the increasing cost of living and offers practical tips on adapting and staying ahead of the game despite these challenges.

1: The Disconnect Between Money and Currency

In today's world, currency and money possess distinct characteristics, though often used interchangeably. In essence, money represents a store of value, maintaining its worth over time. On the other hand, Currency does not retain its value, depreciating with time. One prime example of money is gold, acknowledged as a valuable store of wealth for centuries.

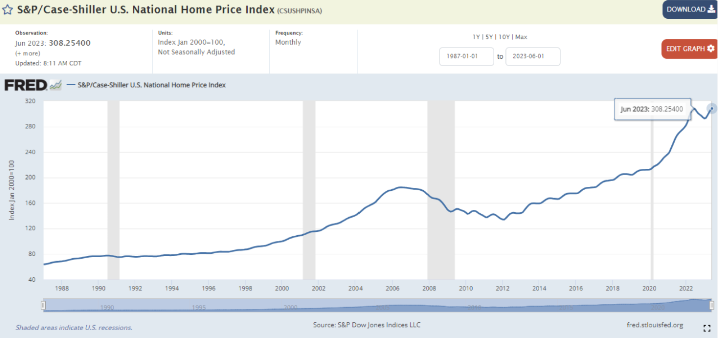

The value of gold has remained consistent over time, making it an excellent store of value. When pricing assets like houses and cars in gold terms, their prices have remained relatively stable in recent decades. However, when pricing them in currency terms, their prices have increased dramatically in recent years.

Source: Boomerang Capital Partners

In the past, money and currency were synonymous, with currencies representing money. For instance, the US dollar was once backed by gold, and other global currencies were tied to its value. This system ensured that receiving payment in a currency meant receiving something that maintained its worth over time.

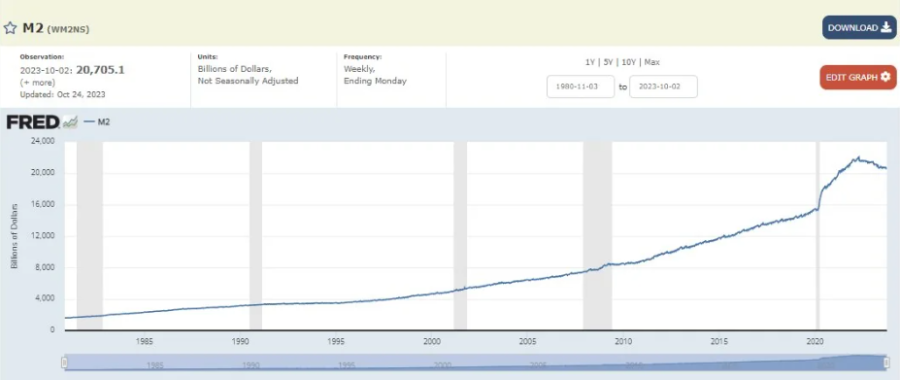

However, in 1971, a significant shift occurred when President Richard Nixon decided to “temporarily suspend” the conversion of US dollars to gold. This move allowed governments and central banks to increase the money supply without being constrained by the need to back it with gold reserves. As a result, the supply of US dollars has grown exponentially since the 1970s, as illustrated in the chart below.

Source: Reddit

According to fundamental economic principles, the greater the quantity of a commodity, the lower its worth. Hence, the rising prices of items such as houses and cars are not due to increased value. Instead, a decrease in the value of currencies is driving this trend. The rise in the amount of currency in circulation is known as inflation, and we are often led to think of it as beneficial for both individuals and the economy. This is because inflation encourages spending.

Individuals tend to increase their spending when the value of their currency is depreciating, which, in theory, can stimulate economic expansion and prosperity. However, in practice, inflation harms the ability to preserve currency value, incentivizing overconsumption. Moreover, official inflation measurements have been underestimating the actual inflation rate for years.

The primary issue with the disconnect between currency and money is that individuals continue to receive their income in currency rather than actual money. To make matters worse, people are being misled into believing that the currency they receive has the same value as it did in the past, with the notion that it's equivalent to gold.

The persistent inflation is why it's challenging to maintain a decent standard of living and achieve financial stability. Your earnings are declining in value while you're attempting to purchase goods that are actually valuable, such as real estate or vehicles. This paradox between money and currency may leave you questioning why currencies have any value at all in today's world.

The answer is basically because the government says so. That's why currency is now more often referred to as fiat currency. The Latin word “fiat” translates to “let it be done”. The English dictionary definition of fiat is “an arbitrary order or decree.” However, this is only one aspect contributing to the perception that the financial system is rigged.

2: The Manipulation Of The Time Value Of Money. (TVM)

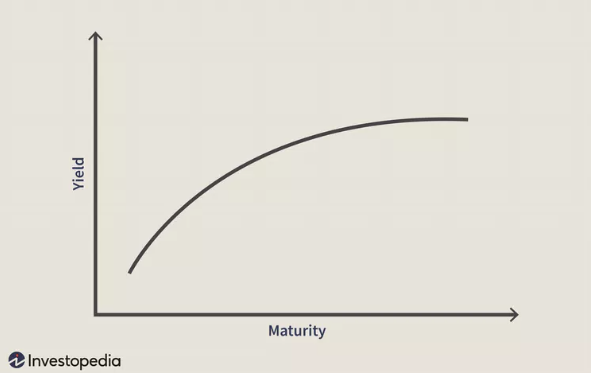

The second factor involves the manipulation of the time value of money (TVM). In this context, the time value represents the cost of borrowing money over a specific timeframe. Typically, the interest rate increases as the borrowing period extends. This is because the lender foregoes potential opportunities that could have been pursued with the loaned money during that time.

For instance, imagine you need to borrow money for a decade. Lenders might be willing to lend it to you if you agree to pay them a 50% premium at the end of the ten years. This is because ten years is a significant amount of time, and they could have earned a comparable return by investing their money elsewhere.

However, suppose you're looking to borrow money for a short period, precisely one year. In that case, lenders might be more willing to approve your request if you agree to pay an additional 5% interest at the end of the term. This is because one year is considered a relatively short time frame. While they could have potentially earned more interest by investing the money elsewhere, it's often more straightforward and less risky for them to just grant the loan.

Source: Investopedia

Combining all these loans and their individual interest rates on a graph would result in what is known as the yield curve, a line that inclines upward and to the right. Essentially, the yield curve indicates that the longer the duration of the loan, the greater the interest rate that must be paid. This is where the situation can become somewhat intricate;

If you're looking to borrow a substantial amount of money for an extended period, you may encounter lenders who require a higher interest rate due to the increased risk involved. For instance, if you want to borrow $1 billion for ten years, lenders might demand an additional 100% interest on top of the initial amount, effectively doubling the total amount you'd need to repay. This is because providing such a significant loan over an extended period involves opportunity costs and entails considerable risks, with the primary concern being the possibility of defaulting on the repayment.

Lenders typically charge a higher interest rate to offset the risk of lending. The yield curve may be steeper and begin at a higher percentage based on the loan amount under normal circumstances. However, in today's market, borrowing for a short period can be more expensive, and some larger loans may have lower interest rates than smaller loans with similar repayment terms.

It may seem surprising, but the primary reason for this is largely attributed to central banks. Typically, loan interest rates are influenced by the balance between the availability of lending and the desire for borrowing. When there is a high demand for loans and a limited supply, interest rates tend to be high, and conversely. However, central banks can manipulate interest rates manually, disrupting the natural market dynamic.

The caveat is that they can manually set the interest rates on shorter debt durations. Before the 2008 financial crisis, this was the only action they took. In response to the 2008 crisis, central banks took the unprecedented step of manipulating longer-term interest rates for the first time in modern history. They did this by buying long-term government debt, which lowered interest rates for similar debt durations.

Until the 2008 financial crisis, central banks only controlled short-term interest rates. They could manually set the interest rates on shorter debt durations. However, in response to the crisis, central banks took the unprecedented step of manipulating longer-term interest rates by purchasing long-term government debt, which lowered interest rates for similar durations of debt. This was a significant departure from their traditional role and marked a new era of monetary policy.

To put it differently, central banks manipulated the time value of money across all time frames, making borrowing cheaper to stimulate economic growth. However, this approach has led to inflation instead of a quicker recovery. By keeping interest rates artificially low, more currency is created out of thin air, not only by governments and central banks but also by individuals and organizations.

As we now know, the value of currency depreciates as its supply increases. Unfortunately, this devaluation has occurred four more times since 2008, thanks to the manipulation of money's time value across all time frames. This has led to higher inflation and continued to make borrowing artificially cheap—but only for those with access to credit.

3: Access To Credit (in a Credit Driven Economy)

In a credit-driven economy, the third factor contributing to the rigged financial system is the disparity in access to credit. The intention behind manipulating the time value of money was to facilitate borrowing for all, thereby promoting economic growth. However, this manipulation had an unintended consequence: instead of making credit more accessible to everyone, it only became easier for select individuals and institutions to borrow, leading to inflation.

These individuals and institutions utilize their funds for various purposes, including acquiring valuable assets such as stocks and real estate. This demand leads to a significant increase in the prices of these assets while the value of the currency used to purchase them depreciates. As a result, the average person can only keep up by borrowing more currency to buy the remaining valuable assets, thereby increasing their prices even further.

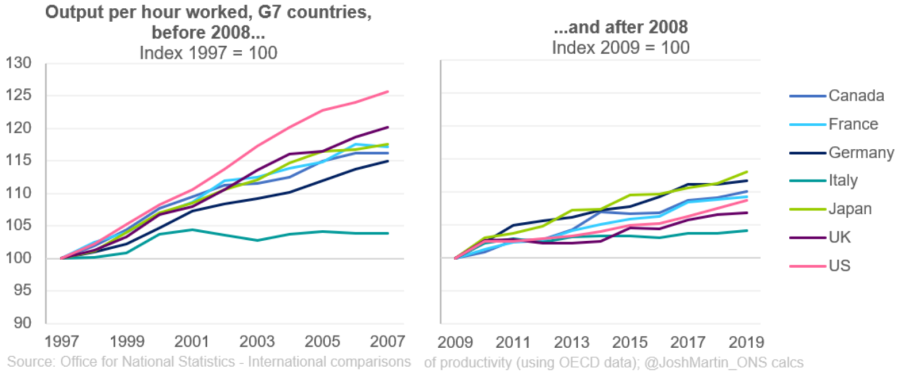

Initially, the various green indicators may appear to signify economic expansion due to their upward trends. Yet, upon further examination, it becomes evident that inflated asset prices have mainly fueled this growth due to low-cost borrowing practices implemented since 2008 rather than genuine economic expansion. Consequently, there has been limited actual economic growth during this period.

For instance, the actual economic output in G20 nations has shown minimal growth since 2008, indicating a reliance on credit. Succeeding in this credit-driven economy largely hinges on your capacity to take on increasing amounts of debt, yet this is becoming more challenging.

Source: X

There are various factors at play, which can be categorized into two main groups: formally established financial regulations and informal norms. The Dodd-Frank Act stands out as a significant example of official financial regulation enacted in response to the 2008 financial crisis.

Although lengthy at over 2,000 pages, the Dodd-Frank Act has essentially created challenges for small banks in providing small loans to small businesses and individuals. As a result, small businesses and individuals now face increased difficulty demonstrating their creditworthiness to secure larger loans, while small banks find it harder to function effectively.

Small banks play a significant role as the primary lenders to small businesses. If small banks are unable to provide small loans to these businesses, there will be a decrease in both small banks and small businesses. This could lead to a situation where large banks and shadow banks become the primary sources of funding for small businesses.

Shadow banks, such as Blackrock, have established their own set of rules and regulations that individuals and institutions must adhere to. One example of this is the ESG investment ideology, which has become a powerful tool for manipulating the value of money. Compliance with Blackrock's ESG standards can result in more favorable loan terms, including lower interest rates, while non-compliance may lead to less favorable loan terms.

The rising prominence of Environmental, Social, and Governance (ESG) criteria in financial decision-making is poised to surpass the influence of traditional financial regulations. This shift is expected to gain momentum as ESG considerations become more widespread and affect individual decision-making. Notably, ESG criteria do not originate from the private sector but were introduced by unaccountable and unelected international organizations.

A concerning aspect of the situation is that credit accessibility is now being influenced not only by commercial banks and shadow banks but also by central banks purchasing corporate debt in response to the pandemic flash crash in 2020. Similar to purchasing government debt, buying corporate debt results in decreased interest rates on that debt. The selective nature of central banks' purchases, favoring certain corporations over others, created an unfair advantage for those chosen corporations as they could access credit at even lower rates.

The prevailing sentiment among macro analysts is that the extent of your credit access is directly linked to your financial standing. In other words, individuals or organizations with substantial wealth or size are more likely to enjoy better terms regarding credit, thus perpetuating their advantageous position and facilitating further growth.

Suppose you're struggling financially or running a small organization. In that case, you may find it increasingly difficult to obtain credit in the future unless you conform to the standards set by powerful financial institutions like BlackRock. Even if you manage to secure credit, it will likely come with less favorable terms than those enjoyed by larger entities, further widening the gap between you and them in an economy that relies heavily on credit.

Image by Markethive.com

Maintaining Financial Stability in a Biased Economic System

Our main question is: How can we stay abreast of this rigged financial system? In this unfair financial climate, it's essential to comprehend the mechanisms at play. Let's be clear: this system has little to do with the traditional concept of capitalism. Instead, we're dealing with a system where currency and money have been decoupled by government intervention, in which currency is losing its value. Central banks manipulate the time value of money, and unaccountable and unelected international organizations control credit access, all while insulating from accountability and democratic oversight.

The situation becomes increasingly complex when considering the significant influence of corporations on government decision-making through lobbying efforts, that the commercial banks technically own the central banks, and governments overseeing various unaccountable and unelected international organizations. As previously stated, the financial system is rigged as these entities collectively hold hundreds of trillions of dollars in debts they cannot repay.

The establishment needs currency to decouple from money so that it loses its value. It also needs the time value of money to be low and regulate access to credit, as uncontrolled borrowing could lead to a chain reaction of defaults, jeopardizing its entire system. This is why there is a strong interest in Central Bank Digital Currencies (CBDCs), as they offer the potential to centralize control over the currency.

In light of these details, it's essential to recognize that heavily indebted entities are attempting to manipulate the financial system to avoid defaulting on their debts. They're trying to achieve this by controlling the currency supply and sparking inflation. To illustrate, imagine them filling a swimming pool while simultaneously regulating its size. They’re not trying to drown us or are targeting us per se. These entities are primarily focused on safeguarding their own interests.

Attempting to stay afloat by treading water will eventually lead to drowning. This places the responsibility on us to discover a method to exert less effort and remain buoyant, figuratively speaking. Unfortunately, staying afloat is no easy feat. A simple solution would be to receive payment in money rather than currency, but that's not a realistic expectation. You won't likely find someone willing to pay you in money for long, as it would be too costly for them.

This leaves the other two factors: Unless you work at a central bank, you won't be able to fix the time value of money and bring interest rates back to reality, and if you tried, you could be fired or worse. That's because all those entities can't afford higher interest rates due to their debts, at least on paper. In practice, they can afford these higher interest rates so long as they have access to credit.

Accessing credit can be challenging and restrictive in terms of compliance unless you're a large institution or a wealthy individual. Even if you manage to secure credit, relying on borrowed money to purchase assets may not be a sustainable or effective strategy for achieving financial success.

Analysts suggest that we might be moving towards a time of increased interest rates. In such a scenario, this floating device would become ineffective. This is particularly relevant for individuals who have borrowed money to purchase a property for rental purposes, leverage that property to secure additional loans for more rental properties, and so forth. You are likely acquainted with someone who has engaged in such financial strategies. This method has been a primary means of economic progress since 2008.

If interest rates remain high over an extended period, it may lead to a chain reaction of forced selling, as the cost of servicing debt becomes unsustainable. This downward spiral could cause asset values to plummet, triggering even more sell-offs. In such a scenario, only two factors can help maintain financial stability, and they are closely interconnected.

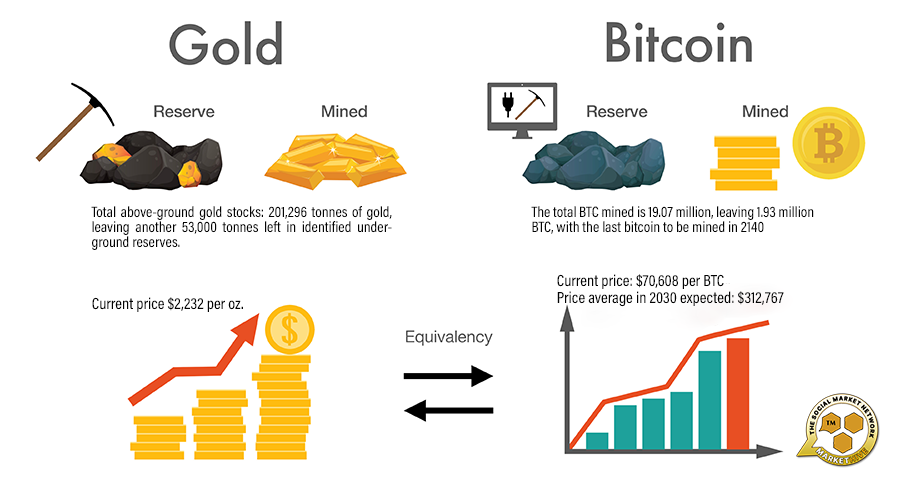

One strategy is to increase the amount of currency you receive, while another is to invest that currency in assets (money) that maintain value, such as Gold, Bitcoin, or otherwise. The main challenge with the first approach is to increase your income without accumulating excessive debt, preferably none at all. With the growing emphasis on ESG (Environmental, Social, and Governance) considerations, securing financing for a small business may become increasingly difficult without meeting strict compliance requirements.

The biggest challenge with the second issue is that governments may impose restrictions on people's ability to access money as they become more aware of the declining nature of the currency. This could lead to difficulties exchanging money for currency when needed.

As individuals become more aware of the manipulation within the financial system, collective adaptation and progress will be facilitated. This awareness leads to the emergence of economies that value money as a legitimate form of currency once more. It seems inevitable that this shift will occur over time. The likelihood of this transformation happening is high, and there may be truth to the idea of reverting to a gold standard or building a new monetary system backed by Bitcoin, the crypto industry’s gold standard, fitting for this digital age, resulting in a parabolic shift in adoption and value for cryptocurrency, so be sure to be positioned accordingly.

This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.