Crypto analysts have been trying to assess the prices of top cryptocurrencies, like Bitcoin, to figure out when the bull market will start.

With the festive season approaching, crypto traders and investors can’t wait for a magic reversal of the market trajectory. The global crypto market cap still traded at $841.83 billion, posting a 1.41% decrease on the previous day.

With the crypto market cap still way below the key $1 trillion mark and Bitcoin price still governed by bears, here’s what some of the top analysts think about recovery.

From Wen Lambo to Wen Bull Market?

Wen Lambo is a term used by someone to mean when will they get rich by selling their crypto holdings. Now, as the crypto market cap trades 73% below its ATH, analysts are trying to find signs of a reversal.

A recent analysis from Crypto analyst bOnchain (@ghoddusifar) highlighted when the market drops to delta cap, the bull market will start. The analyst predicts that, historically, delta cap has been the market cap support for Bitcoin. The market cap of Bitcoin has not yet reached the delta cap.

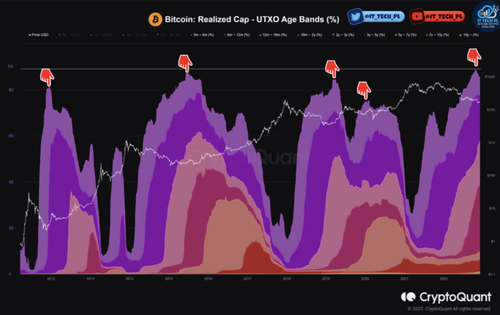

Another CryptoQuant Analyst, IT Tech, believes that BTC is approaching the bottom of the cycle, looking at its Unspent Transaction Output (UTXOs). Notably, UTXOs over six months old take almost 90% of the realized cap. In the previous cycles’ sell-off, in Sept. 2015, and April 2019, this indicator reached over 70% and then started decreasing.

In the past, when the value started to decline for each group then, the Bitcoin price slowly recovered. The youngest group has already turned around. If other groups also start to turn, it could mean that a price bottom is near.

Predicting the Crypto Bull Run

Huobi founder Du Jun in a recent interview, said that a new crypto bull run could only take place after the next halving event. This is scheduled to take place in 2024.

The last halving took place in May 2020, then in 2021, Bitcoin made an all-time high above $68,000. Similarly, when a BTC halving event took place in 2016, BTC prices hit another record high the following year.

Pseudonymous analyst SmartContracter said that he believes the recent Bitcoin price appreciation is a corrective rebound. However, the BTC price is set to make a new low sub $15,000 into Q1 2023, where it can find a longer-term bottom.

Lastly, a recovery of the total DeFi total value locked, which currently sits near a two-year all-time low, can mark a recovery from the bear market.

DeFi total value locked | Source: Defillama

The total value locked currently sat at $41.74 billion, 77% down from its Nov. 2021 all-time high. If a bull run does kick-in institutional flows in the DeFi space would rise, thus pointing towards the start of a bull market.