Central Banks Concerns About Rising Crypto Adoption. Report Paradoxically Depicts Bullish Outcome For Crypto

Crypto adoption is on the rise, and it may well be argued that the central banks don't like that fact. Recently, the BIS, monikered as the so-called ‘Bank for Central Banks,’ published a report claiming that crypto adoption causes financial instability in developing countries, where adoption is happening the most.

Central banks of the United States, Mexico, Brazil, and other major Latin American countries conducted the report. Their concerns about crypto adoption paint a surprisingly bullish picture. This article provides an overview of this report, explains the significance of what's being said, and tells you what it could mean for the crypto market.

The report summarized here is titled “Financial Stability Risks from Crypto Assets in Emerging Market Economies.” It was published by the Bank for International Settlements (BIS) in August 2023. The report begins with a foreword that analyzes crypto adoption in developing countries. It includes recommendations on how to keep crypto under control.

Source: Cointelegraph

BIS member central banks of Argentina, Brazil, Canada, Chile, Colombia, Mexico, Peru, and the United States wrote the report. The representatives set up a task force led by the BIS Americas Office as the secretariat. It seems to claim that crypto adoption in developing countries is high because these countries generally have low financial literacy. This starkly contrasts with a recent study by a U.S. university, which found that crypto adoption actually increases financial literacy. This makes sense, considering that you must understand crypto before adopting it.

About The Report

The report's first section provides a summary of the key findings. The authors are hyper-focused on the rise and fall of the crypto market. They don't seem to care about why people are adopting crypto but simultaneously acknowledge the reasons why. For example, As quoted, “Proponents of crypto assets claim that they offer lower transaction costs, faster payments, no intermediation, anonymity, and potentially high returns on investment. Whether they deliver on these claims is another matter.”

The second part is surprising, as they refuse to argue against it. Moreover, it states, “For some users, crypto assets provide an alternative to limited investments and savings instruments, while for others, they offer a seemingly safe haven against volatile domestic currencies.”

Now, this conflicts with what the authors implied in the forward. They know those adopting crypto are informed. In other words, they know exactly why people in developing countries embrace crypto; because their fiat currencies suck. Instead of addressing these shortcomings, the authors essentially conclude that something must be done to keep crypto under control because of supposed financial stability risks.

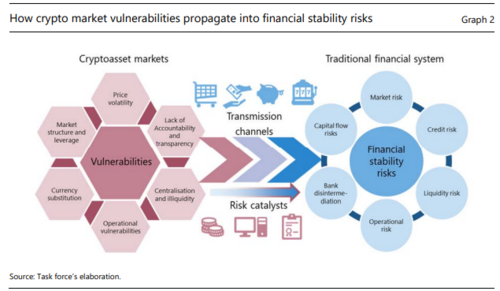

The authors then highlight several risks, in particular, market risks due to volatility, liquidity risks due to a lack of transparency, credit risks due to a lack of governance, AKA control, operational risks due to cyberattacks, currency substitution risks, and capital flow risks, due to crypto’s use in cross-border payments.

The irony is that many assets are more volatile than crypto. The existing financial system is even less transparent than the crypto industry, traditional finance (TradFi) has exponentially more credit risk than decentralized finance (DeFi), and cryptos are more resilient to cyber-attacks because they're more exposed; they are literally tested every day. This underscores the fact that the only risks the authors are concerned about are currency substitution and capital flows.

To address these risks, they claim that “Authorities can consider selective bans, containment, and regulation,” a classic starting point for these BIS reports. For those interested, here is a summary of another crazy BIS report from last year.

The report begins with an introduction where the authors explain cryptos and how they work. They then divide crypto into two categories for their analysis: stablecoins and unbacked crypto assets, which means everything else: Bitcoin, Ethereum, et al. For context, central banks hate stablecoins, probably because they’re direct competitors to Central Bank Digital Currencies (CBDCs). Interestingly, governments seem to like stablecoins because they're backed by government debt. This means they can use stablecoins to subsidize their spending.

The authors explain that this report builds on recent work by the Financial Stability Board (FSB), a subsidiary of the BIS. Notably, the FSB’s crypto recommendations become regulations in its member countries, namely the G20. The work the BIS is building on is a crypto framework put together by the FSB, which can be seen in the image below. This infographic is ironic because it notes that stability risks only flow from crypto to TradFi. As we've seen with the banking crisis, the stability risks come from TradFi, not crypto.

Source: BIS Papers: Financial stability risks from crypto assets in emerging market economies.pdf

Before breaking down the alleged risks crypto poses to TradFi, the authors make another eye-opening claim,

“The crypto universe was built on the promise of an efficient, decentralized, low-cost, inclusive, safe and open monetary system, but structural vulnerabilities in the design and operation of crypto asset markets make them unsuitable as the basis for a monetary system.”

The key word here is ‘monetary’; the central banks oversee the monetary side of the financial system. In practical terms, this means raising or lowering interest rates through various mechanisms to affect the amount of currency in circulation. It's clear that they do not want to lose control of this ability.

The Alleged Risks

Market Risk

As stated above, the first crypto risk is market risk. Firstly, the authors implied that publicly traded crypto companies are inherently risky. They also take issue with the fact that some cryptos are held mainly by a handful of wallets. They provide some fascinating statistics to back up their claims,

“In 2020, an estimated 10,000 individuals owned about a quarter of all outstanding Bitcoin. Satoshi Nakamoto, the anonymous creator of Bitcoin, is the largest holder, with more than 1 million stored in different wallets (around 5% of the total). Other tokens show similar concentration. For example, fewer than 100 participants control over 51% of the value in Dogecoin, ZCash, and Ethereum Classic.”

So, at first glance, these statistics are concerning, but it's easy to forget that there's even more extreme wealth concentration in other asset classes. It exemplifies the top 1% reportedly earned more than the rest of the world combined over the last two years. Why isn't the BIS raising this point?

The second thing worth noting is that most of the authors' concerns around market stability are directed at stablecoins, which should come as no surprise, given that they are competitors to CBDCs, as mentioned earlier.

Source: Bitcoin Treasuries

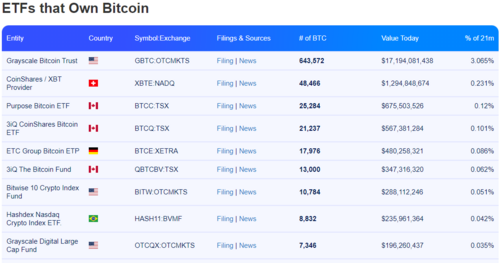

What is surprising is that the authors also target spot Bitcoin ETFs, quoting, “Bitcoin ETFs could potentially pose a market risk in emerging market economies (EMEs) by lowering the barriers to entry for less sophisticated investors and increasing investors' direct and indirect exposure to crypto assets.”

Oddly enough, the authors are concerned about the wealth concentration Bitcoin ETFs could cause. Here are a few more statistics; “As of end-March 2023, ETFs owned a combined 819,125 BTC, 3.9% of the total bitcoins to be issued (21 million). The largest Bitcoin ETF is Grayscale Bitcoin Trust (GBTC), which owns 643,572 BTC, or nearly 3% of the total supply. In total, ETFs, governments, and public and private companies own more than 1.6 million BTC, approximately 7.8% of the total supply.”

Source: Bitcoin Treasuries

Liquidity risk

The second crypto risk is liquidity risk. The authors note that most of crypto’s trading volume occurs on offshore exchanges such as Binance. What's odd is that they include Huobi Global as one of the top crypto exchanges and a potential point of concern when it's no longer that large.

Source: Coinmarketcap.com

Oddities aside, the authors also aim for Tether and allege that its USDT stablecoin is still insufficiently backed. They missed the memo that USDT is now backed almost entirely by US Government debt, like all the other major stablecoins. It appears that the BIS is making arguments using outdated data.

Anyhow, there’s something else that the authors point out, which is quite essential: money market funds were a significant source of market instability in 2008 and 2020. For those unfamiliar, money market funds are kind of like TradFi stablecoins. The difference is that you earn a yield on them.

Naturally, the authors note that stablecoins are similar and that if they were to experience a run, this could create problems for the assets that back these stablecoins, namely government debt. The thing is that most money market funds are significantly more extensive than most stablecoins and, therefore, riskier.

Credit Risk

In any case, the third is credit risk. The authors define credit risk in the context of crypto as “The potential that a counterparty in crypto-asset markets or directly exposed to crypto assets could fail to meet its obligations in accordance with agreed terms.”

Areas of concern include interconnectedness between crypto companies, citing FTX and Alameda Research. Also, lack of governance and disclosures, quoting DAOs and leverage, citing DeFi. They also included crypto exchanges having access to bank accounts, citing Chilean authorities, who forced banks to bank crypto exchanges.

Despite favorable crypto regulations, crypto companies and projects in pro-crypto jurisdictions still have difficulty opening bank accounts. This is likely due to the Financial Action Task Force (FATF), but this pressure could be from the central banks.

Operational Risk

Regardless, the fourth crypto risk is operational risk. The authors take issue with the fact that cryptos use blockchains, quoting, “One of the key features of blockchain technology is its irreversibility. Once a transaction is recorded on the blockchain, it cannot be undone. This feature can be problematic in situations where transactions need to be reversed, such as in the case of a hack or fraud.”

News flash: If crypto transactions could be reversed, then there would be no point in having crypto because governments, central banks, and Wall Street could manipulate it. Just like they do with money and other assets. In case it wasn't clear enough, they want to be able to do this with crypto, too.

Disintermediation Risk

The fifth crypto risk is bank disintermediation risk. This includes both currency substitution and reserve currency substitution, which are significant concerns for the central banks. The authors admit that crypto could “..reduce the monetary authority’s control over liquidity in the economy, thus weakening the effectiveness of monetary policy…”

The authors reiterate why people would substitute their fiat currencies with crypto. These reasons included not trusting the fiat currency, crypto being more efficient than fiat, and crypto being more private than fiat, which isn't accurate, at least in the case of cash.

The reserve currency substitution section is where things get seriously bullish for crypto. They quote, “…if crypto assets become mainstream, they could also replace the global reserve currency as a perceived store of value…” The report denotes this substitution process as cryptoization 2.0. Put simply, the authors speculate that crypto could compete with reserve currencies, like the US dollar, if they see enough adoption.

The caveat is that they're saying this in the context of developing countries, where they think crypto will be used to evade capital controls. Even so, this pertains to something speculated about in a previous article about the BRICS countries. It’s possible they could adopt a cryptocurrency as their common currency. The fact that BRICS’s current and future members fit the profile of the countries described in this BIS report underscores this possibility.

Capital Flow Risk

The final crypto risk is capital flow risk, another big concern for the central banks. That's because crypto allows people to move their money around without asking for permission from Big Brother; that's not allowed in the modern financial system. The report’s authors are frustrated about the fact, quoting,

“Crypto assets can operate offshore and hence beyond regulatory oversight. Crypto assets can be traded and stored on a global network of computers, often offshore servers and digital wallets, making it possible for them to operate beyond the jurisdiction of any one country.”

They're also upset that, quote, “…a person can create a digital wallet on a computer or mobile device and store crypto assets in it, without having to go through any formal registration process or identity verification.” Note that they want to connect all crypto wallets to digital IDs eventually.

To drive the point home about crypto capital flows being a risk, the authors provide another statistic, saying: “One of the biggest Mexican crypto exchanges claimed that in the first half of 2022, it processed remittances for $1 billion in crypto assets, approximately 3.6% of the total flow in that period.” This is bullish for crypto.

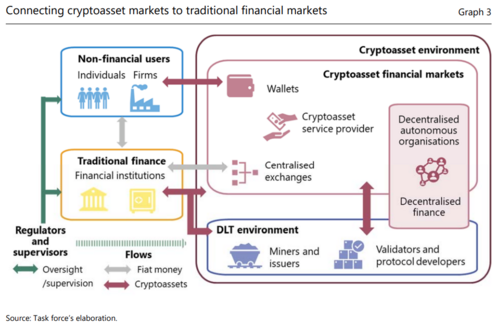

Crypto Risk Connection To TradFi

This begs the question of how these crypto risks could spill into the traditional financial system. The third part of the report has all the answers from the perspective of the BIS. These are summarized in a single infographic (below) that shows the connection between crypto and TradFi. These include crypto to fiat, on and off ramps, stablecoins backed by government debt, etc.

Source: BIS Papers: Financial stability risks from crypto assets in emerging market economies.pdf

What's crazy is that the authors suggest that even if crypto risks don't spill over into TradFi directly, they could spill over indirectly. The report states,

“Disruptions in the cryptoasset market can potentially spill over to other financial markets through confidence effects. For example, a sharp drop in the value of crypto assets could erode investor risk appetite. This could lead to outflows from the traditional financial system and tighten financial conditions.”

Put differently, if the crypto markets crash, this could spook investors in TradFi, and that would cause issues; therefore, crypto must be regulated, contained, banned, etc.; it’s madness. It also makes no sense because the opposite is true; stocks influence crypto’s price action, not vice versa.

Crypto Adoption In Developing Countries

All of these allegations about crypto risks could be intended to prime the reader for the fourth section, which is crypto adoption in developing countries. After all, if they believe crypto is so risky and harmful, they will need to ensure those unfortunate folks in the global South are extra protected. Quips aside, the authors detail four so-called risk catalysts for developing countries regarding crypto.

- Crypto adoption

- Inflation and a lack of central bank credibility

- Lack of payment infrastructure and financial literacy (Arguably not true)

- A lack of crypto regulation (or rather, the lack of anti-crypto regulation that central banks want to see)

Recommendations For Controlling Crypto

Following a lengthy overview of all the crypto regulations in select North and South American countries, the authors provide recommendations about controlling crypto in the fifth part of the report. They start by saying that there are three approaches to managing crypto: bans, containment, and regulation.

They say that many authorities have argued that crypto should not be regulated because regulations would give the industry a seal of approval that could lead to more adoption. Regulations mean institutions and institutions represent lobbying for better regulations. Believe it or not, the authors aren't in favor of a crypto ban because it would mean no oversight of crypto. They also do not favor containment, i.e., keeping crypto separate from the financial system, because they know secret connections would inevitably manifest.

So, the one option remaining is to regulate crypto, specifically with the same risk and regulation principle. If you've read this article about crypto regulations, you'll know that this principle could turn crypto into another arm of the existing financial system, which would defeat its purpose. One of the entities pushing this principle the hardest has been the World Economic Forum (WEF), which the authors cite many times in this report.

For developing countries specifically, the authors recommend they get their monetary business in order so that there's no incentive for crypto adoption. Indeed, if the central banks and governments manage their currencies properly, crypto probably wouldn't exist because it wouldn't need to exist. They only have themselves to blame at the end of the day, and with a bit of luck, crypto will force them to be somewhat more responsible going forward.

What Does It Mean For Crypto?

What does all of this mean for the crypto market? In short, it's very bullish. The central banks are aware that crypto adoption is growing fast and is ultimately due to deficiencies in the existing financial system, which they know they probably can't fix. These deficiencies are especially acute in developing countries, and for good reason.

The US dollar is the world's reserve currency, and it's used in up to 96% of international trade in some regions. Unless a country has many resources, it has difficulty getting its hands on US dollars. These countries can only get US dollars by requesting an IMF or World Bank loan. These loans come with many conditions, which are typically in favor of the US and US-based corporations.

Now, the consequence of this is that these indebted developing countries just can't get ahead. As pointed out by macro analyst Lyn Alden, only a handful of developing countries have managed to become developed over the last 50 years. For the ones that manage, it was due to their natural resources, especially oil. Some of the only exceptions are South Korea and Taiwan, both of which have received significant support from the US over the decades, probably for geo-political purposes.

The rest of the developing world has been stuck in the same place, sometimes worse, and they're starting to understand why. Consider that even the BIS referred to "The global reserve currency in their cryptoization 2.0 prediction.” The keyword is ‘The’ä¸it's singular. Logically, it's a reference to the US Dollar. Assuming it is and probably is, the BIS’s cryptoization quote reads: "If cryptocurrencies achieve mainstream adoption, they could replace the US dollar as the world's reserve currency.”

Now consider that this is something that many central banks could be interested in; remember that the BRICS are a thing. This would explain the somewhat paradoxical conclusions of the BIS report, which is to regulate crypto even though they know that it will inevitably result in more crypto adoption.

When you combine this conclusion with the fact that the BIS will allow central banks to hold up to 2% of their balance sheets in crypto starting in 2025, you begin to realize that some central banks might be breaking ranks. In fact, it's possible they're all breaking ranks except the Federal Reserve. That would be truly something, wouldn't it?

(34).gif)